1. Magnesium resource output

Magnesium is one of the most abundant light metal elements on earth. Magnesium ranks eighth in the universe, 2% in the earth’s crust, and third in seawater. According to data from the China Nonferrous Metals Industry Association, China’s magnesium resource output in 2020 was 858,300 tons, up 1.6% year-on-year, and China’s magnesium resource output in January-April 2021 was 288,300 tons.

China’s magnesium resource output and output are the highest in the world, with an output of 904,600 tons in 2017, accounting for 85.29% of global output, far higher than other countries.

2. Distribution of magnesium ingot output

China is the country with the highest magnesium ingot output in the world. In 2019, China’s magnesium ingot output accounted for 82% of global output, followed by Russia, with magnesium ingot output accounting for 7% of global output; third is Israel, with magnesium ingot output accounting for 2% of global output; fourth is Brazil, with magnesium ingot output accounting for 1% of global output.

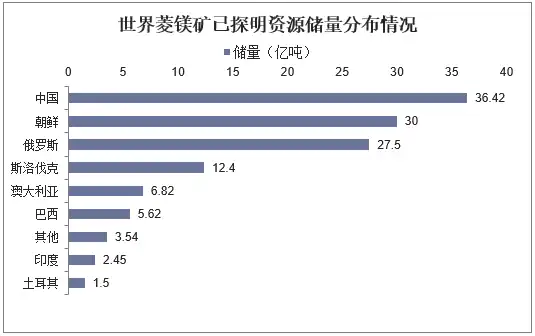

3. Magnesite production and reserves

my country has abundant magnesium resources, with proven magnesite reserves of 3.642 billion tons, accounting for 28.85% of the world’s total reserves, ranking first in the world. Among them: crystalline magnesite reserves are 3.571 billion tons, accounting for 98.05% of the country’s total reserves, and cryptocrystalline magnesite reserves are 0.71 billion tons, accounting for 1.95%.

There are 27 mining areas with proven reserves of magnesite in my country, distributed in 9 provinces (regions). Liaoning has the richest magnesite reserves, mainly concentrated in the area from Yingkou to Dashiqiao to Haicheng. Shandong is second. In addition, magnesite is also relatively rich in Tibet, Xinjiang, Gansu and other regions. Moreover, the main resource characteristics of magnesite in my country are relatively concentrated reserves and more large deposits; the deposit types are relatively single, mainly accretionary metamorphic-hydrothermal replacement magnesite; especially the ore quality in Liaoning Province is excellent, and the general MgO content is 46%-47%.

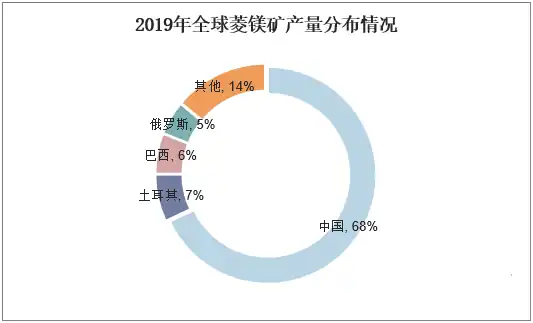

According to data from the United States Geological Survey, my country’s magnesite production in 2019 was 19 million tons, accounting for 68% of the world’s total, 9.5 times the production of the second-ranked Turkey.

4. Magnesite import and export

China’s magnesite exports have grown rapidly, especially in 2017, from 173 tons in 2016 to 294,046 tons in 2017. After 2017, China’s magnesite exports also grew rapidly. By 2020, China’s magnesite exports were 508,391 tons, up 19.25% year-on-year. From January to April 2021, China’s magnesite exports were 140,066 tons.

China’s magnesite is exported to 13 countries including Japan and Indonesia. Among them, China exports the highest amount of magnesite to Japan, with exports reaching 347,000 tons in 2020, far exceeding other countries. China exports the most magnesite to Japan. On the one hand, Japan is an island country with a small territory and a serious shortage of domestic mineral resources, so it needs to import a large amount of ore; on the other hand, Japan is close to China, and the freight cost of importing ore from China is low and the time is short.

As my country’s magnesite is mined one after another, my country’s magnesite production has increased, and the demand for foreign magnesite has gradually decreased. By 2020, China’s magnesite imports were 5,726 tons, a year-on-year decrease of 84.16%. From January to April 2021, China’s magnesite imports were 1,157 tons.

Pakistan is the country from which China imports the most magnesite, with an import volume of 4,260.7 tons in 2020, far exceeding other countries. The second is Turkey, with China’s magnesite imports of 1,421.2 tons in 2020; the third is the United Kingdom, with China’s magnesite imports of 36 tons in 2020. China imports the most magnesite from Pakistan, mainly because China and Pakistan are close, freight costs are low, and time is short.

5. Distribution of downstream demand for magnesium resources

The downstream demand for raw magnesium is mainly divided into: deep processing of magnesium alloys (automobiles, 3C die-castings), aluminum alloys (construction, transportation) metallurgical additives (aluminum alloys, rare earth alloys, steelmaking desulfurization, etc.), and other fields (metal smelting reducing agents, etc.); and about 70% of the global magnesium alloy die-casting products are consumed in the automotive field and 20% are used in the 3C field. Considering that about 20% of the downstream aluminum alloys are used in the transportation field including automobiles, the industry that has the most significant impact on magnesium prices is the automotive industry.

6. China’s major magnesium producers

The domestic raw magnesium production capacity is highly dispersed, and the leading companies are absolutely leading: At present, the concentration of the magnesium industry is relatively low, with CR3 at 13.8% and CR10 at 31.6%. There are only 13 companies with a production capacity of more than 30,000 tons, with a total market share of 35.9%, and the remaining majority are companies with a production capacity of 5,000-20,000 tons. Yunhai Metal’s raw magnesium production capacity is 100,000 tons, ranking first in China, with a market share of 7.2%, far higher than the 65,000 tons of production capacity of Yinguang Huasheng Magnesium Industry, the second in the industry, with obvious scale effects and significant competitive advantages. As the national environmental protection pressure continues, high-cost backward production capacity is gradually cleared, and the industry concentration is expected to continue to increase in the next 3-5 years.

7. Development trend of China’s magnesium oxide industry

Due to the increasing domestic environmental protection pressure, it is not only magnesium oxide that is difficult to start and reduce production. Downstream coatings, papermaking, plastics, inks and other industries have been hit harder, resulting in continued weakness in demand. Many companies that cannot enter the industrial park are facing closure; companies that can enter the industrial park also need time to relocate. Under the high pressure of environmental protection policies and regulations, group warming and resource integration seem to be the general trend of the magnesium oxide industry.