Magnesium Hydroxide Market Analysis

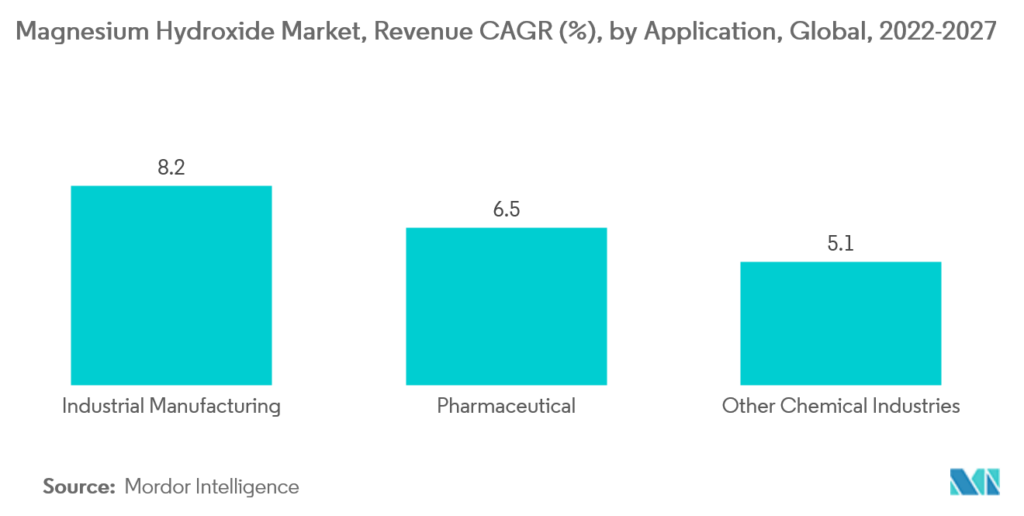

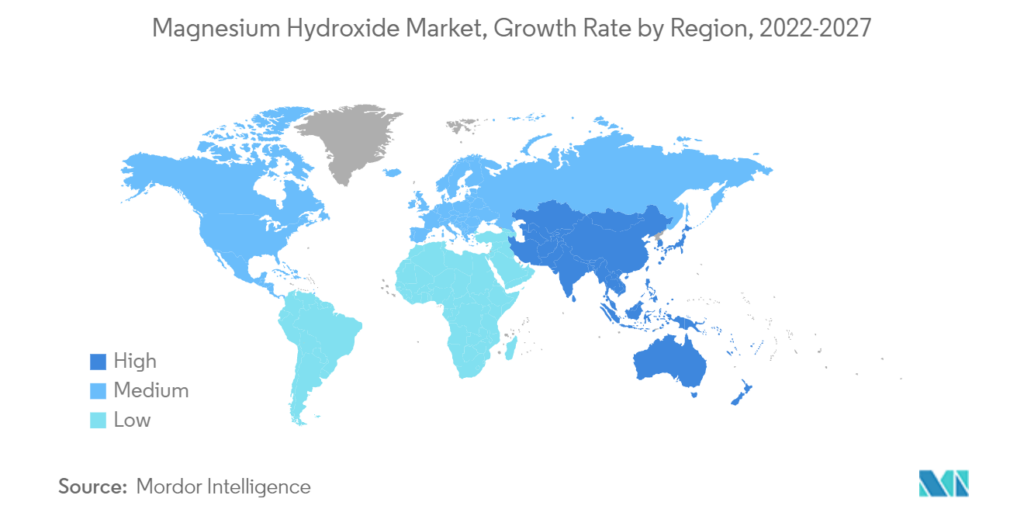

The magnesium hydroxide market is expected to register a CAGR of over 7% during the forecast period. During the COVID-19 pandemic, the demand for different chemical products has drastically decreased due to nationwide lockdowns and strict social distancing regulations, resulting in market closures. However, the market is expected to grow steadily owing to increasing demand from the pharmaceutical industry. The major factor driving the market is the demand for pharmaceuticals, industrial chemicals, and intermediates. The availability of alkaline bulk chemicals such as sodium and calcium hydroxide will hamper market growth. The growing demand for wastewater treatment chemicals is a key market opportunity. Asia Pacific dominates the global market with China and India accounting for the largest consumption.

Magnesium Hydroxide Market Trends

Increasing Demand in Industrial Manufacturing

Magnesium hydroxide is widely used in desulfurization and wastewater treatment in industrial manufacturing units. Moreover, magnesium hydroxide is mainly used as an antacid in the pharmaceutical sector.

Magnesium hydroxide is also used in petrochemicals, electronic coatings, etc.

The expansion of the industrial sector across the globe is likely to increase the demand for magnesium hydroxide to provide wastewater treatment and desulfurization and to improve the performance and efficiency of industrial processes.

The continued economic strength in Asia Pacific and the corresponding increase in demand for infrastructure, machinery, manufacturing units, and others is likely to drive the demand for industrial chemicals in the region. Moreover, the expansion of production units and increasing investments in the region are expected to provide new opportunities for end-user industries such as steel, chemicals, oil and gas, manufacturing, and construction.

An increasing number of multinational companies are shifting their production to other Asia Pacific countries such as Taiwan, India, Malaysia, the Philippines, Thailand, Singapore, and Indonesia. These countries have a strong reputation in manufacturing and have seen foreign direct investments (FDI) in various sectors. Moreover, government policies in these countries have attracted foreign players and promoted the establishment of factories.

Europe is home to many large coatings industries and has four of the largest continental economies, including Germany, France, Italy, and Spain. The presence of several prominent players in the region is expected to expand the industrial coatings segment over the forecast period. The development of the industrial sector is expected to favor the demand for magnesium hydroxide in the industrial sector to improve the performance of industrial equipment and other machinery.

The demand for industrial chemicals in the Middle East and Africa region is expected to be strong due to the ongoing structural reforms in the region. Furthermore, the announcement of Vision 2030, coupled with the associated National Transformation Program (NTP), and increased investments in various sectors such as healthcare and education in Saudi Arabia are likely to drive the demand for magnesium hydroxide during the forecast period.

Therefore, industrial chemicals may impact the market demand due to the factors mentioned above.

APAC to Dominate the Market

In the APAC region, China’s real GDP grew by 2.2% and 8.1% in 2020 and 2021, respectively, driven by a rebound in consumer spending after the pandemic. China has doubled the amount it has invested in public hospitals to $38 billion over the past five years. It aims to increase the value of its healthcare industry to $2.3 trillion by 2030, more than double its current size. Furthermore, the Chinese government has begun to introduce policies to support and encourage domestic medical device innovation, providing opportunities for the market studied. The Made in China 2025 initiative has improved industry efficiency, product quality, and brand reputation, which will stimulate the development of domestic pharmaceutical companies and improve their competitiveness. China is the second largest healthcare market in the world. However, the country imports technologically advanced implants from developed economies. The country’s public hospitals are the main consumers of medical devices in the country. In 2021, public healthcare expenditure was 1.92 trillion yuan.

According to the International Monitoring Fund (IMF) forecast, India’s GDP will grow by 8.9% by 2021. The country has resumed its industrial activities, which are expected to drive economic growth in the second half of the forecast period. The GDP is expected to reach 8.2% in 2022. In India, at the end of 2021, the Union Health Minister announced various plans of the Indian government to improve the country’s medical facilities. The government plans to invest 641.8 billion Indian rupees in the country’s healthcare sector over the next six years. The government plans to strengthen the existing National Health Mission by developing the capacity of primary, secondary, and tertiary healthcare systems and institutions to detect and treat new and emerging diseases.

Magnesium Hydroxide Industry Segmentation

Magnesium hydroxide is an alkaline compound formed by the reaction of magnesium oxide and water under controlled conditions. This bulk chemical is widely used in chemical manufacturing for desulfurization and wastewater treatment applications. In the pharmaceutical industry, it is used as an antacid and laxative and as an intermediate in different chemical reactions. The magnesium hydroxide market is segmented into industrial, pharmaceutical, and other chemical industries based on application. By geography, the market is segmented into Asia Pacific, North America, Europe, South America, and the Middle East and Africa. The report also covers the market size and forecast for the magnesium hydroxide market in 15 countries across key regions. For each segment, the market size and forecast are provided based on value (US$ million).

FAQ

What is the current market size of magnesium hydroxide?

The magnesium hydroxide market is expected to grow at a CAGR of over 7% during the forecast period (2024-2029)

Who are the key players in the magnesium hydroxide market?

Elementis PLC, Kyowa Chemical Industry, NikoMag, Premier Magnesia, Messi Biology,Israel Chemicals Ltd. are the major companies operating in the magnesium hydroxide market.

Which region is experiencing the fastest growing magnesium hydroxide market?

The Asia-Pacific region is estimated to grow at the highest CAGR during the forecast period (2024-2029).

Which region holds the largest share in the magnesium hydroxide market?

Asia Pacific will hold the largest market share in the magnesium hydroxide market by 2024.